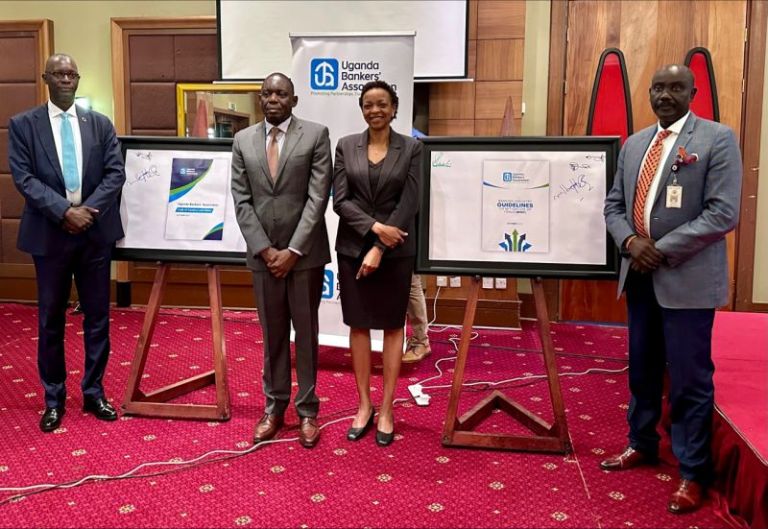

In response to the escalating fraud issue, Ugandan commercial banks, operating under UBA, unveiled comprehensive measures.

The Banking Industry Guidelines on Mitigation of Fraud (BIGF) and the revised Code of Conduct (COC) aim to crack down on financial crime.

The BIGF establishes guidelines for incident reporting and information sharing, fostering a strategic roadmap to combat fraud effectively.

It also aims to formulate a strategic roadmap to effectively combat fraudulent activities within the industry.

Similarly, the COC stresses professionalism and ethics, with stringent measures against staff breaching confidentiality or colluding with fraudsters.

It includes stringent measures against banking personnel who breach confidentiality obligations or collude with fraudsters to compromise access to systems or share sensitive information.

The COC stresses professionalism and ethics, with stringent measures against staff breaching confidentiality or colluding with fraudsters.

Sarah Arapta, UBA Chairperson, emphasized the need for decisive action against fraud, aiming to address evolving trends and empower customers.

Furthermore enhances standards, and fosters collaboration with domestic and international anti-fraud agencies.

Dr. Michael Atingi-Ego, Deputy Governor of the Bank of Uganda, highlighted the frameworks’ role in strengthening trust and confidence.

He underscored the synergy between the BIGF and COC, emphasizing their collective contribution to combating financial crime effectively.

At a Financial Fraud Forum, weak legal penalties were identified as a significant challenge in combating financial crime.

UBA Executive Director, Wilbrod Owor, urged banks to maintain operational vigilance during weekends and public holidays, prime times for criminal activity.

Data from the Uganda Police shows fluctuations in reported cyber crimes and corporate frauds by banks.

Despite some decrease in certain categories, the overall trend suggests an increase in economic and corruption crimes nationwide.

As the banking sector grapples with fraud, these measures signify a significant step in safeguarding the financial system’s integrity.

As a result, collaboration between regulatory authorities, law enforcement agencies, and industry associations is crucial for a safer financial environment for all.