The difference between the rich and the poor often isn’t just about how much they make, but also about how they handle their money. Those who are wealthy tend to have a growth mindset, which means they believe in their ability to learn, develop, and improve over time.

Rich men are planners, while poor men live day-to-day. Successful men take the time to think ahead and plan their financial future. They save and invest with the long-term in mind. Poor men generally don’t make financial plans and struggle to think about tomorrow.

The rich do this through a budget.

What is budgeting?

Budgeting is the process of creating a plan on how to spend your money or income.It helps you balance what you earn with what you need to spend, making it less likely for you to end up in debt in the short or medium term. Having a budget means you’re more likely to have enough money for the things you need and the things that matter to you. It also helps you stay out of debt or get out of debt if you’re already in it.

“Budgeting is not just for people who do not have enough money. It is for everyone who wants to ensure that their money is enough.” – Rosette Mugidde Wamambe

Budget forecasting /planning

Budget forecasting is like looking ahead to plan how you’ll spend your money. It helps you see when you might have tight months and when you might have extra cash. This planning is crucial because it lets you set aside money for important things like vacations, buying a car, getting a home, emergency savings, marriage, or retirement. By using a realistic budget to predict your spending for the year, you can better plan for the future and keep your finances in good shape.

Becoming rich is hard. Staying broke is hard. Choose your hard. – Eric Worre

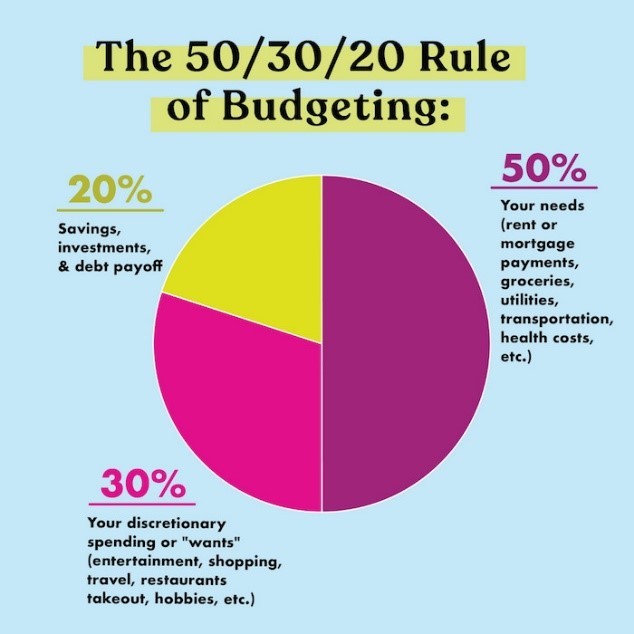

Before looking into some steps of budgeting, please note the 50-30-20 rule that will help you organize spending into needs, wants, and goals.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Needs: 50%

About half of your budget should go toward needs. These are expenses that must be met no matter what, such as:

- Utility bills

- Rent

- Health care

- Groceries

If you can honestly say “I can’t live without it,” you have identified a need. Minimum required payments on a credit card or a loan also belong in this category.

Wants: 30%

You subscribe to a streaming service to watch your favorite show, not because you need the subscription to live. Wants are things you enjoy that you spend money on by choice, such as:

- Subscriptions

- Supplies for hobbies

- Restaurant meals

- Vacations

Savings: 20%

The remaining 20% of your budget should go toward the future. You may put money in an emergency fund, contribute to a retirement account, or save toward a down payment on a home. Paying down debt beyond the minimum payment amount belongs in this category, too.

Here are some steps for making a better budget.

Step 1: Establish Clear Financial Goals

Begin by defining your financial objectives for the next year. Determine the desired income and monthly expenditures to serve as benchmarks, guiding your financial decisions. Setting these goals is fundamental to achieving financial freedom.

Step 2: Identify Income Sources and Expenses

Thoroughly list all income sources and expenditures to gain a comprehensive understanding of your financial situation. Tracking expenses is crucial, as it provides insight into spending habits and prevents potential debt accumulation.

Step 3: Prioritize Needs over Wants

Distinguish between needs and wants to effectively manage your finances. Prioritize essential expenses over discretionary spending, ensuring financial decisions align with practical necessities rather than emotional impulses.

Step 4: Develop a Personal Spending Plan

Craft a spending plan tailored to your income, avoiding the temptation to mimic others’ budgets indiscriminately. Align expenses with earnings, striking a balance to cover all financial obligations and goals.

Step 5: Implement Your Financial Plan

Commit to executing your spending plan meticulously, adhering to predetermined allocations for each expense category. Avoid overspending driven by emotional impulses, and uphold financial discipline to achieve your objectives.

Step 6: Prepare for unexpected expenses

Prepare for unforeseen expenses by allocating funds for seasonal or unexpected financial obligations, such as school expenses or emergency situations. Planning ahead minimizes the risk of resorting to debt to cover unexpected costs.

Step 7: Continuously Improve Financial Management

Recognize that mastering personal financial planning is a gradual process. Embrace self-discipline and embrace a mindset of continual learning and improvement. Seek professional guidance when necessary to refine your financial strategy.

Step 8: Seek professional guidance if needed:

Consider consulting a financial advisor for expert assistance in creating and managing your budget, especially if you have complex financial circumstances or investment goals.

“A budget isn’t about restricting what you can spend. It permits you to spend without guilt or regret.” – Unknown

budgeting is not merely a tool for those with limited resources; it is a fundamental practice for anyone striving for financial stability and success. By adopting a proactive approach to managing finances, individuals can prioritize their needs, fulfill their wants, and secure their future through savings and investments. Embracing a growth mindset, coupled with disciplined budgeting habits, empowers individuals to navigate the complexities of personal finance with confidence and resilience. Remember, the journey to financial freedom is not always easy, but with dedication, strategic planning, and a commitment to continuous improvement, anyone can pave the way towards a brighter financial future.

Truth be said,I think the poor don’t budget simply because they earn little money and whatever they earn is already budgeted for and so it gets done without them saving. Another thing, poor people don’t think out of box, they think the only to survive is to always be working for the rich as they earn the little they do and little do they know that the rich became rich because they started up something small that helped them invest more and more.

Ji